TRUSTED BY

The YuVin Advantage

Why Yuvin

Dynamic, Tailored Videos at Scale

AI-generated videos that adapt content uniquely to each borrower’s repayment journey.

- Leverage proprietary AI to create realistic, culturally relevant personas for authentic communication.

- Adapts messaging and tone based on borrower behaviour and repayment history for maximum relevance.

Engage Borrowers Visually

Simplifies complex repayment instructions, creating clarity and driving immediate borrower action.

- Replaces confusing text-based communication with engaging, easy-to-understand visual narratives.

- Fosters a sense of empathy and trust through face-to-face style communication.

Instant Scalability with Cost Savings

Leverages automation for high-volume, personalized video communication at significantly reduced operational costs.

- Enables rapid deployment of campaigns for various debt stages with minimal setup time.

- Reduces agent and field-based operational costs through automated, high-volume outreach.

Discover the Future of Collection

Discover how YuVin transforms debt collection through personalized borrower videos — enhancing understanding, engagement, and repayment rates.

improvement in borrower repayments

Increase in campaign effectiveness

Languages Supported

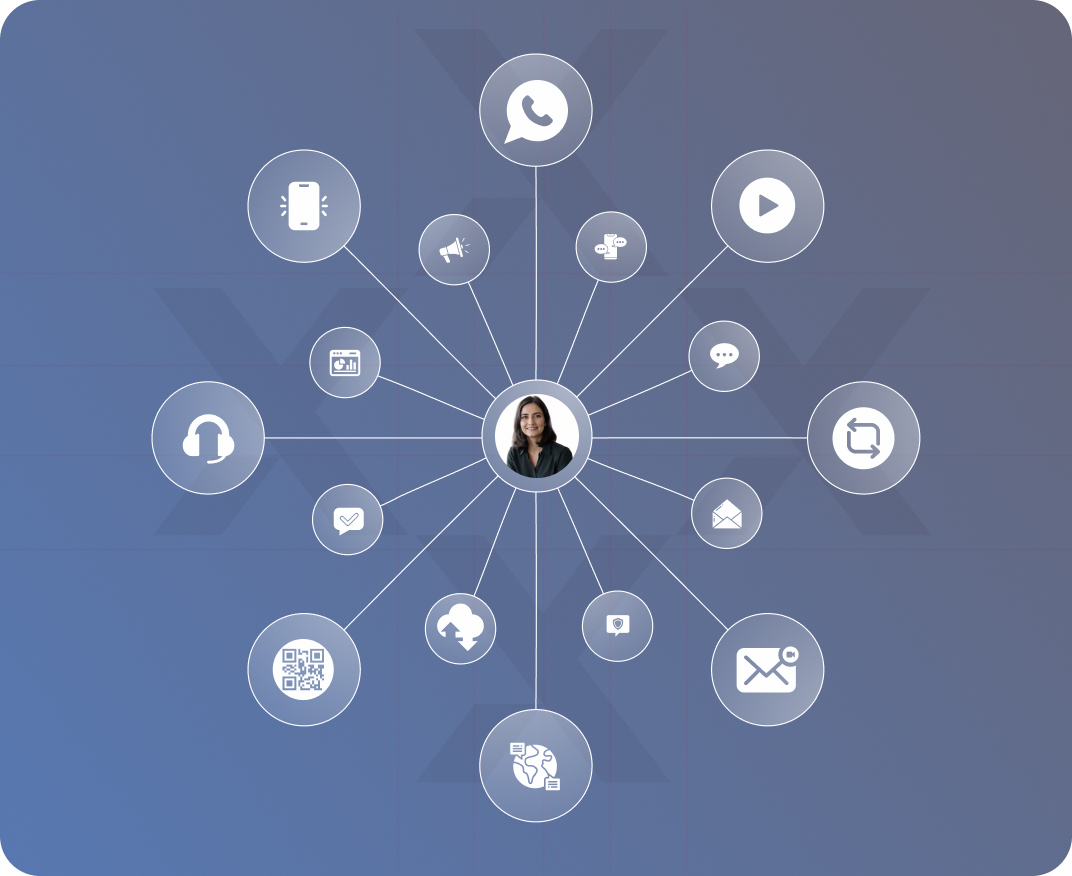

Connect Effortlessly Across Every Channel

SMS

Quick video links for instant borrower access.

Secure, interactive video messages via trusted messaging apps.

Engaging visual emails increasing borrower response rates.

Experience Higher Engagement and Better Results with YuVin

YuVin videos achieve measurable improvements

Higher Borrower Engagement

Up to a 15% increase in borrower responsiveness through personalized and interactive communication.

Improved Clarity on Repayment

Over 20% better understanding of repayment terms, reducing confusion and increasing compliance.

Lower Operational Costs

Significantly reduced costs compared to traditional collection methods, making recovery more efficient.

Culturally Relevant Conversations That Resonate

YuVin isn’t just multilingual—it’s culturally intelligent. It tailors videos to borrower demographics, regions, and traditions, using localized storytelling to build trust and boost engagement.

Region-Specific Customization

Tailors videos to match local customs, traditions, and sensitivities.

Festival & Occasion Awareness

Engages borrowers by seamlessly integrating relevant local festivals, holidays, and events.

Colloquial and Dialect Adaptation

Adapts content to regional dialects, idioms, and expressions, making conversations authentic and relatable.

Transform Your Debt Collection

Enhance efficiency with intelligent communication solutions.

Ensure Seamless Borrower Conversations

Human-like interactions that drive higher resolution rates

Learn More

Achieve Results with Precision

Outcome-based flows that adapt to each borrower's response

Learn MoreFAQs

Find answers to your most pressing questions about our services and how we can help.

Privacy Preference Center

Strictly Necessary Cookies

Essential for the site to function properly.

Performance Cookies

These cookies allow us to count visits and traffic sources so we can measure and improve the performance of our site.

Functional Cookies

These cookies enable the website to provide enhanced functionality and personalisation.

Targeting / Marketing Cookies

Used to track visitors across websites for advertising and targeting.

Third Party Cookies

Cookies set by services that appear on our pages, such as social media or embedded content.

Other Cookies

Other uncategorized cookies that are being analyzed.