Credit Recovery through Debt Collection Software Platforms

Credit Recovery through Debt Collection Software Platforms

Digital lending in India is at a revolutionary pace, growing by leaps and bounds over the upcoming years. As far as statistics are concerned, digital disbursement of credit is expected to surpass INR 47.4 lakh crore by 2026. This revolutionary change can be mapped to a number of reasons.

The worker population has increased from 45.2% in January, 2023 to 46.9% in January, 2024. By 2021, 78% of the Indian population owned a bank account, in sharp contrast to 44% in 2011. This indicates a growing number of people with access to money as well as to banking services.

With smartphone penetration in India being as high as 52%, translating to 751.5 million people, the internet has been made accessible to the last mile.

The government’s focus on building a digital ecosystem of data and going cashless has led to the creation of a digital trail of information. Interconnected systems and platforms require use of digital Aadhar, PAN and GSTIN, with facilities services like e-KYC and Digilocker enabling digital transactions through UPI.

There exists a wide credit gap in India’s market, and digital lending has had a mammoth share in attempting to reduce this vacuum. There has also been a rise in demand for small ticket personal loans – with a volume of 68 lakh loans having an average ticket size of 25,000 registered in FY 2023.

An increasing trend in the adoption of digital credit, specifically in the segment of small-ticket, high volume loans has led to a credit ecosystem that has adapted quickly to the system of digital lending in order to facilitate the process. However, to bring the digital credit ecosystem to a full circle, it is imperative that it is complemented by digital debt collection platforms that can handle this vast sea of data.

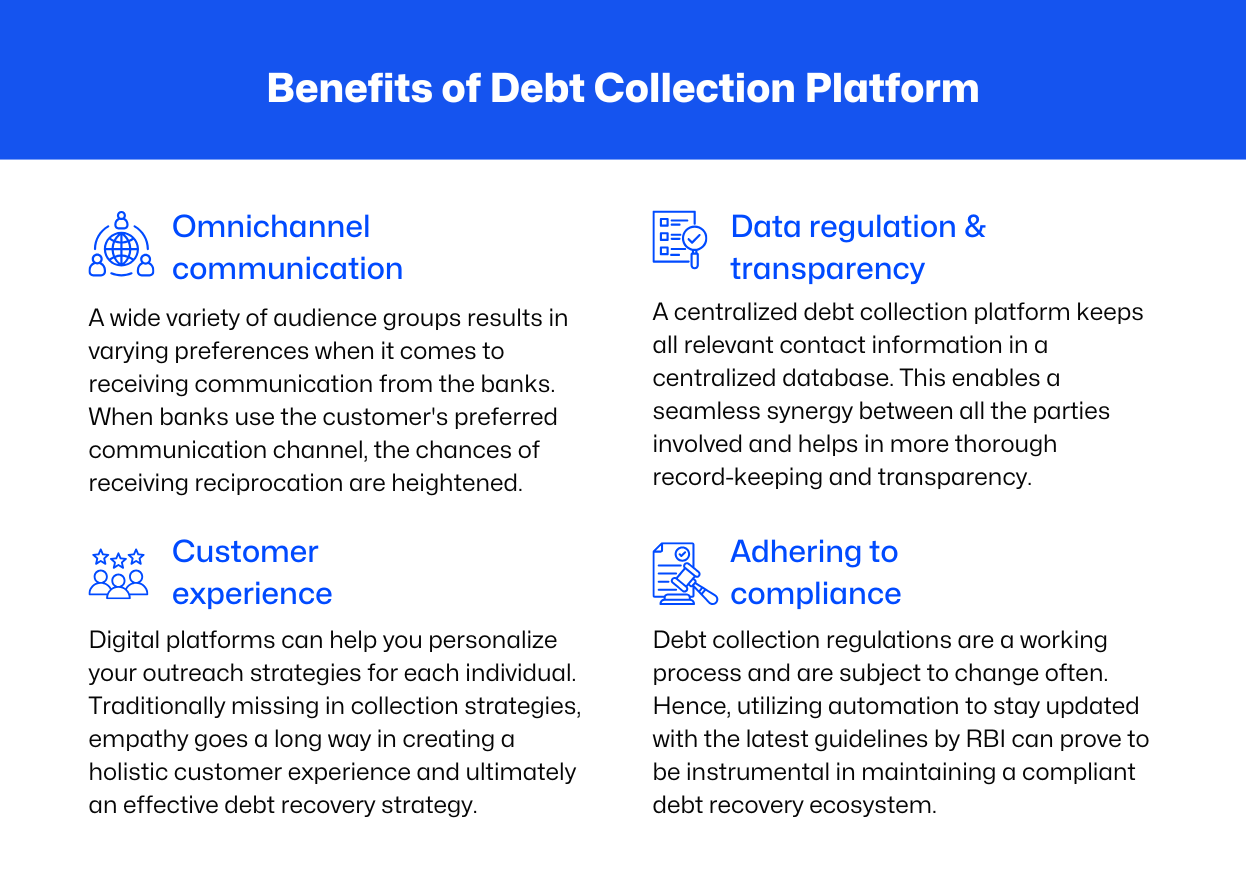

A debt collection software platform is a tool specifically curated to help automate and simplify the process of debt recovery for the user by tracking, managing and recovering outstanding debt. Such platforms operate on the foundational principles of ease of use, efficiency and time management; to eliminate human error and to ease redundancy in the process.

Traditionally, the following steps are involved in the process of debt collection.

The lender will reach out to the borrower to send them a reminder about the due date. This communication may take place on the channel of SMS, calling, letters, etc.

If there’s friction between the lender and the borrower regarding repayment terms or amount, the next step would be to negotiate modes or channels of payment to enable effective debt collection.

It is important to have every form of communication well-documented in the process as it might turn out to be instrumental in the long run.

If common terms can’t be reached, as the next step, the creditor might initiate legal proceedings and file a lawsuit in an attempt to recover the amount outstanding.

Now, involving automation, this is how a debt collection software platform helps you throughout the process.

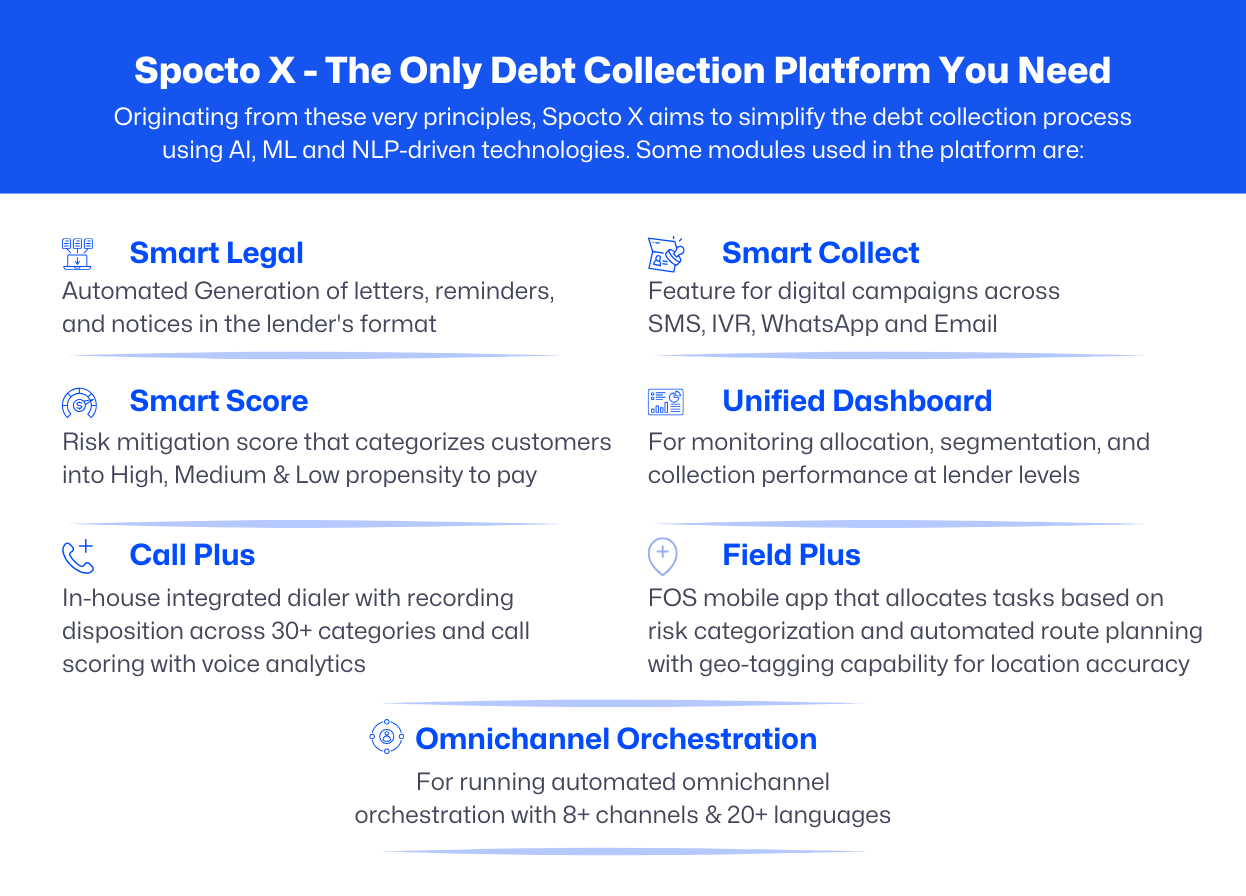

Originating from these very principles, Spocto X aims to simplify the debt collection process using AI, ML and NLP-driven technologies. Some modules used in the platform are:

Some additional features that add to spocto X’s efficiency.

Essential for the site to function properly.

These cookies allow us to count visits and traffic sources so we can measure and improve the performance of our site.

These cookies enable the website to provide enhanced functionality and personalisation.

Used to track visitors across websites for advertising and targeting.

Cookies set by services that appear on our pages, such as social media or embedded content.

Other uncategorized cookies that are being analyzed.