AI agents go beyond traditional collections, driving debt collections effectively.

Streamlines debt collections with precision, efficiency, and intelligent decision-making

Fully Automated Collection Strategy Execution

Data-driven predictive collections strategy that engages the right borrower at the right time through the right channel.

Seamless Digital Collections that Engage Every Borrower

AI orchestrates borrower outreach across digital channels, adapting in real-time to behavior and preferences for higher engagement and faster collections.

Bhaasa – Human-Like Voice Interactions for Collections

An AI-driven conversational engine delivering human-like, 20+ multilingual interactions with real-time adaptability and cost-efficient scalability.

YuVin - Driving Personalised Video Engagement

Video messaging that enhances debt collections, payment reminders, and customer engagement with tailored, multilingual communication..

YuCI - Conversational Intelligence

The only AI that guarantees 100% compliance, ensuring regulatory adherence with real-time transcription, compliance alerts, and proactive risk monitoring.

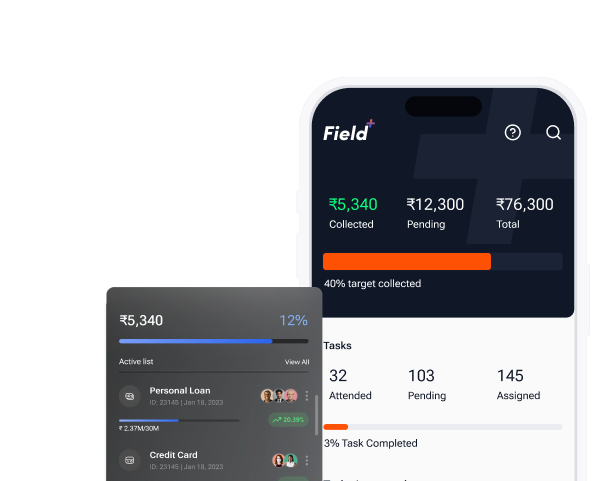

Seamless Field Operations & Optimisation

Automates agent tasking, geo-tracking, and scheduling while optimising performance with real-time insights and seamless borrower interactions.

Advanced CRM & Predictive Dialing Infrastructure

Optimized call prioritization, automated dialing, and a unified CRM enhance borrower engagement, increase conversions, and accelerate collections.

Built-in Compliance & 100%

Risk-Free Collections

Real-Time Monitoring & Transcription

Real-Time Monitoring & Transcription

Tracks borrower interactions, transcribes calls, and flags potential compliance breaches instantly.

Proactive Risk Alerts

Proactive Risk Alerts

Instant notifications help prevent compliance breaches before they happen.

Regulatory Adherence at Every Step

Regulatory Adherence at Every Step

Ensures every collection activity aligns with industry regulations and lender policies.

Automated Audit Trails & Reporting

Automated Audit Trails & Reporting

Every borrower engagement is logged, ensuring full transparency and regulatory readiness.

A nationwide workforce enhanced by AI agents

93% Pan-India Coverage

A vast, trained network of 6,000+ field agents and 3,500+ DRA-certified call center agents ensures seamless collections across the country.

AI-Assisted Call & Field Operations

AI-powered insights, predictive task allocation, and real-time tracking help agents engage borrowers more effectively..

Strategically Located Call Centers

Operations in Noida, Chennai, Mumbai, Bangalore, Kolkata, and Hyderabad provide multilingual, region-specific outreach.

Enhanced Productivity & Compliance

AI agents assist human experts with real-time call monitoring, compliance tracking, and performance analytics, making collections more efficient and risk-free.

Real-Time Monitoring & Transcription

Real-Time Monitoring & Transcription Proactive Risk Alerts

Proactive Risk Alerts Regulatory Adherence at Every Step

Regulatory Adherence at Every Step Automated Audit Trails & Reporting

Automated Audit Trails & Reporting